~Credit Cards In India!

This post outlines the features and benefits of having a credit card in India.

Should you have a credit card?

That's one of the questions I've always had and most people I spoke to told me to stay away from credit cards because it would lead to an endless consumption cycle and bills piling up and a forever trap of debt!

Scary thought, isn't it?

By nature, I am a risk averse simpleton and thus I stayed away from credit cards for years.

Was it a good decision?

I would say, absolutely not!

I wish I had got a credit card from the day I had started working! It would have helped me so much.

Read on to find out my views about credit cards.

1. A credit card is an excellent tool to save money - if used correctly.

We should understand the difference between credit and debit cards first. So, I will explain that.

A debit card is given to each and every person who holds a bank account. Think of it like an ATM card with the added benefit of using it to buy stuff at stores.

Let's say you want to withdraw Rs. 100 from your bank account via the ATM. It's simple - you go to the ATM, insert the card, enter your PIN, and withdraw money.

The money is instantly debited from your account.

Now, let's say you want to purchase a book from a bookshop. You go there and swipe your debit card, enter your pin, and make the payment.

Again, the money is instantly debited from your account.

The key takeaways from this is that

the money is debited instantly.

I only use debit cards to withdraw money from my bank account.

I suggest you also adopt this approach.

Use debit cards only for the purposes of withdrawing money from the bank and to use the grid behind the card for approve for online money transfers.

What about purchases then?

Use only credit cards!

Why? The benefits attached with credit cards are far far better than those with debit cards.

2. Which credit card to select?

This is an important question and the answer is - it depends.

If you fly often, there are few credit cards which are better than others because they add rewards points to your card when you buy air tickets which enables you to upgrade to business class/first class or use an airport lounge.

If you own a car and fill fuel often, there are few cards which are more useful for you because these cards waive off fuel surcharges and give you more rewards points if you use online IndianOil petrol pumps, etc.

So which one is it?!

I do not own a car, I fly rarely and thus I do not have these types of cards.

I have three cards and I will explain my reasons for having these cards.

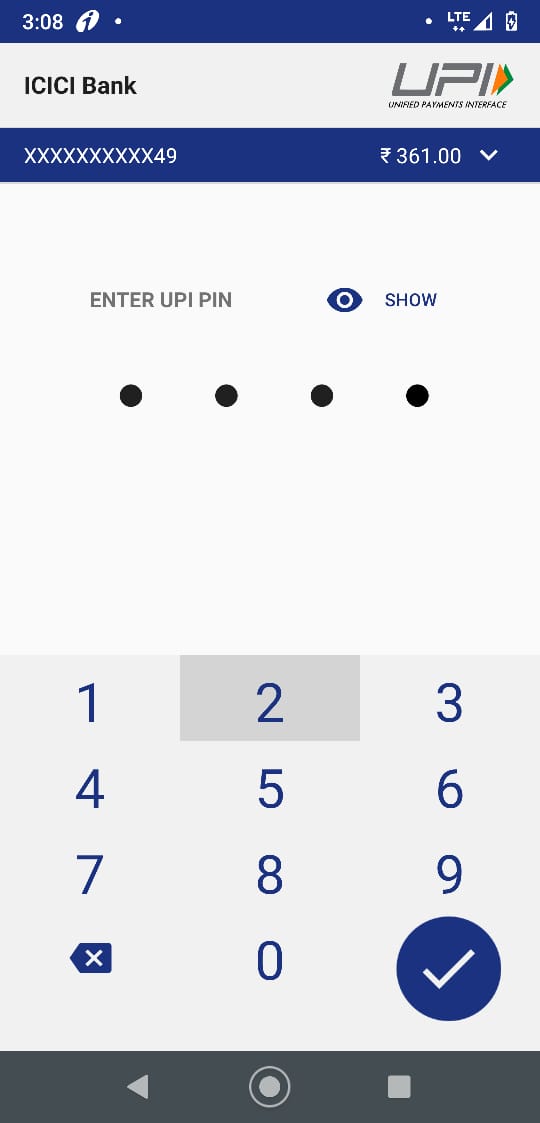

1. Amazon Pay ICICI Bank Credit Card.

The official website for this card is

https://www.icicibank.com/Personal-Banking/cards/Consumer-Cards/Credit-Card/amazon-pay/index.page?#toptitle

The best part about is that there are NO joining and annual fees, forever.

It's essentially a free credit card.

It helps to get this card faster if you have an ICICI Bank account - which I did have. This is because they already have a history of your purchases, actions on your bank account, etc.

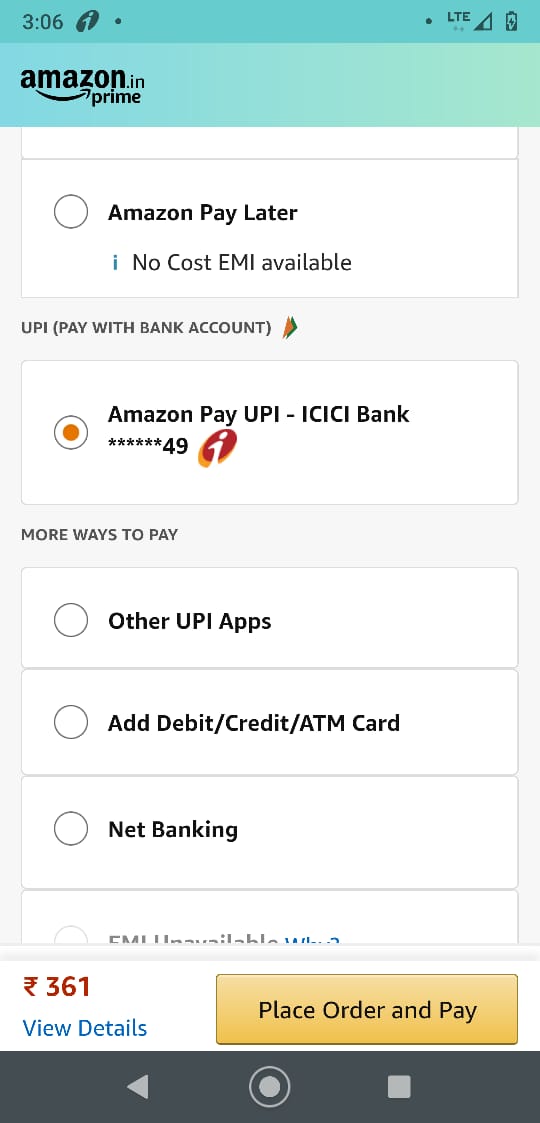

If you are an Amazon Prime member, there is an unlimited 5% reward points for purchases on Amazon.in, except for flight bookings, e-books, gift cards (both physical and digital), loading Amazon Pay balance, utility bill payments, mobile and many other reward points. There are other offers too on the website mentioned above - please check that for a detailed view. But for a gist of things, there is a 1% cashback on almost all transactions.

This is great because even if you make a large purchase once for example a laptop of Rs. 60,000, you will end up getting back Rs. 600 because you just used this card - this is awesome, isn't it? This Rs. 600 can be used to pay for your postpaid bill or buy purchase few items from the Amazon website.

The money is got back in the form of Amazon Pay balance and this can be used buy products from the website or pay bills, etc.

This is the best card I have and I mostly use this for all my purchases.

I suggest you also try and get hold of this card as soon as possible!

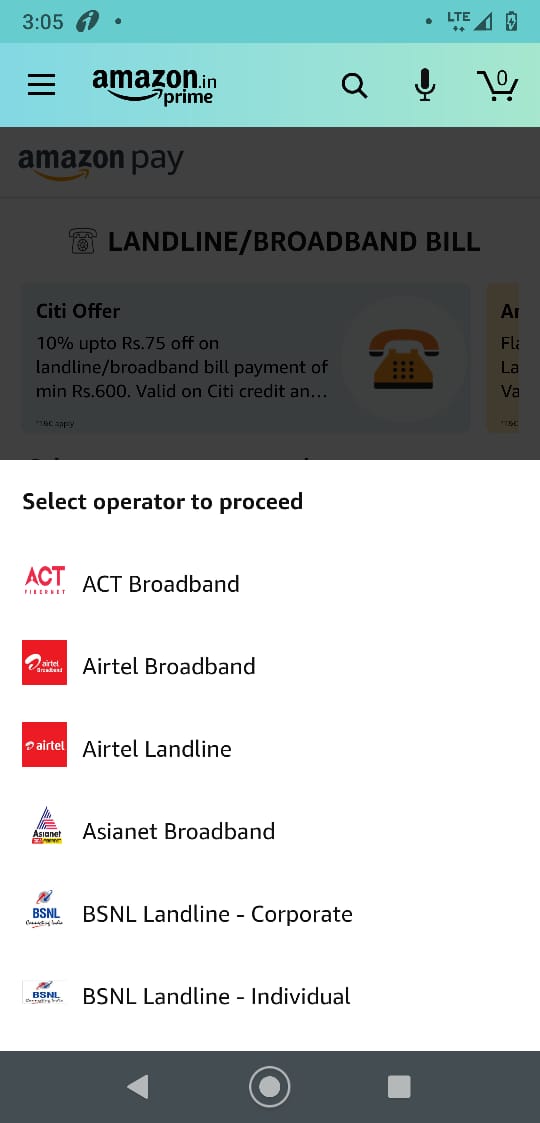

2. Citi Rewards Credit Card

You can get this credit card by simply filling up the form on the website. Their representative will call you and come home to take a few standard documents like the following:

Proof of Identity

Proof of Address

Latest two salary slips

The documents mostly needed are a combination of one or more of the following:

Valid Passport issued by Govt. of India

Valid Driving License

Proof of possession of Aadhaar number (Aadhaar Card/ E-aadhaar)

Voter's ID Card

Job Card issued by NREGA duly signed by an officer of the State Government

Please check the website from time to time for an updated set of documents.

The benefit of the card is that there was no joining fee. There is currently an annual fee of Rs. 1,000 + taxes but this is waived off if you make purchases of at least Rs. 30,000 in a year from when you get the card - the yearly billing cycle.

In my view, Rs. 30,000 is a small sum when it is spread out over a year so you can essentially waive off the annual fees. Just be careful about spending Rs. 30,000 in that yearly billing cycle.

You get many discounts on wsbites like Flipakrt and Amazon as well if you make purchases using this Citibank Credit card. This is a great card to have because you can make payments safely, activate international transactions on this card - country wise using the Citibank App.

3. Syndicate Bank Global Visa Credit Card

To be honest, I got this credit card out of desperation. I needed this card to make car rental bookings when i was in South Africa and a credit card was a necessity for me to have. I mostly never use this card.

I only use it when i need to make international purchases because the exchange rate used by public sector banks is slightly lesser than private banks and this is helpful to save a little money. These cards typically don't have any annual and joining fees.

My advice is to use this card as a last resort.

3. Use your credit card like a debit card:

As explained before, when you use a debit card, the money is debited instantly from your account.

But, with a credit card, you get a time period which is close to a month, to pay for the purchase you made.

Let us say that you bought a phone for Rs. 14,000 on 15th January and will need to pay for this phone by 10th February or so.

If you had used a debit card, the amount of Rs. 14,000 would be debited instantly.

But, if you have a limit of Rs. 60,000 in your credit card, you will see that the new limit is now Rs. 46,000 because Rs. 14,000 has been spent on your phone.

As long the payment is made by 10th February, you are safe. You should NOT forget this.

If you miss the date, the bank starts levy interest - typically 3-4% per month which is close to 45% annually. can you imagine paying Rs. 14,000 + close to Rs. 7,000 more for that phone!

It's insane - but that's how it is.

What should you do then so that you do not forget to make this payment?

One way is to link your bank account with your credit card using an auto debit facility on the 9th or so, so that the entire bill amount of the credit card is debited from your account.

Whenever I have tried doing this, it has not worked for me!

I guess something sinister happens with my account - maybe they want me to pay interest for the purchases I made! :D

Hell No!

What I do is, I pay the amount instantly. so I will typically make the payment to the credit card bank on the night of the purchase itself - this is me using my credit card like a debit card.

No tension then! The payment has been done and plus all the reward points and cashbacks! :D

I have never missed my payment even once and the bank definitely hates having me as their customer because I don't generate any interest for them due to missed or late payments! :D

I have thus successfully earned thousands of rupees by just paying for the purchases i have made and getting the cash back in terms of Amazon Pay balance - you can too by following the tips above!

Thanks for reading my post and I hope it helps you! :)

Cheers,

Rupak.